In this gallery, we examine the top funds that led the pack.

Over the past three years, MENA and GCC equity markets have been on a roller coaster ride. In 2020, the year of the pandemic, GCC markets dipped by -3.7%, as against 15.9% surge in EM and 14.1% rise in MSCI World indices. In 2021, the tide began to turn and the GCC markets ended the year with a staggering 34.9% gain, even though their EM peers dropped -4.6%.

This year so far, hammered by high interest rates, soaring inflation, and the Ukraine-Russia war, MENA markets ended the first half of the year flat after a good performance in the first four months of the year.

However, MENA equity funds held their ground to deliver positive three-year return during the tumultuous years.

In this gallery, we examine the top 10 funds that led the pack. The analysis is based on funds registered for sale in the region. Performance figures are presented in USD terms unless otherwise specified.

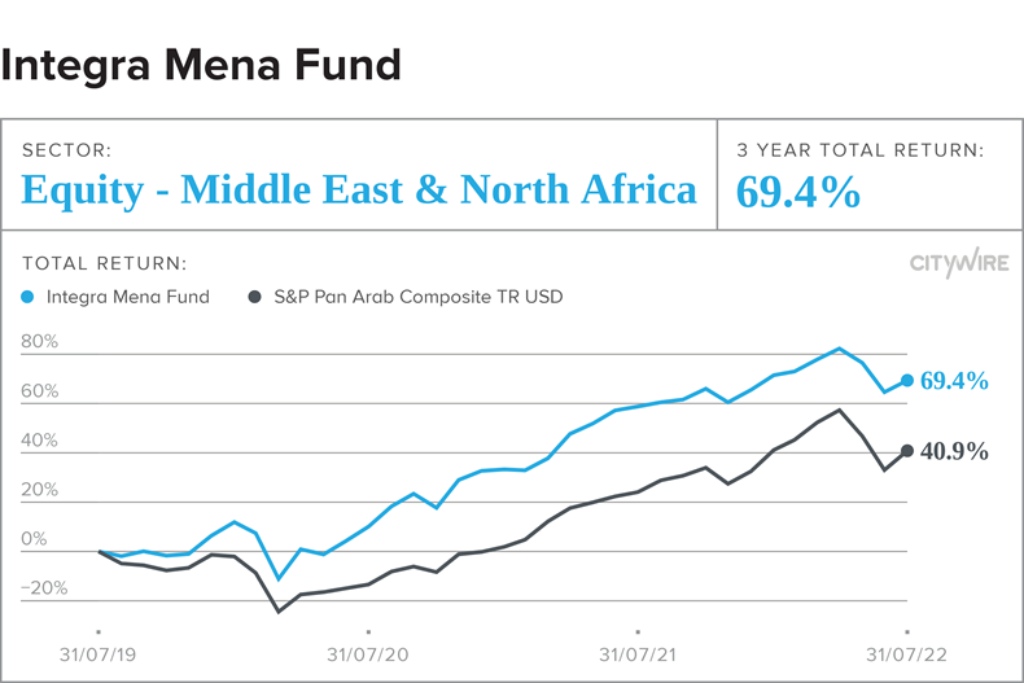

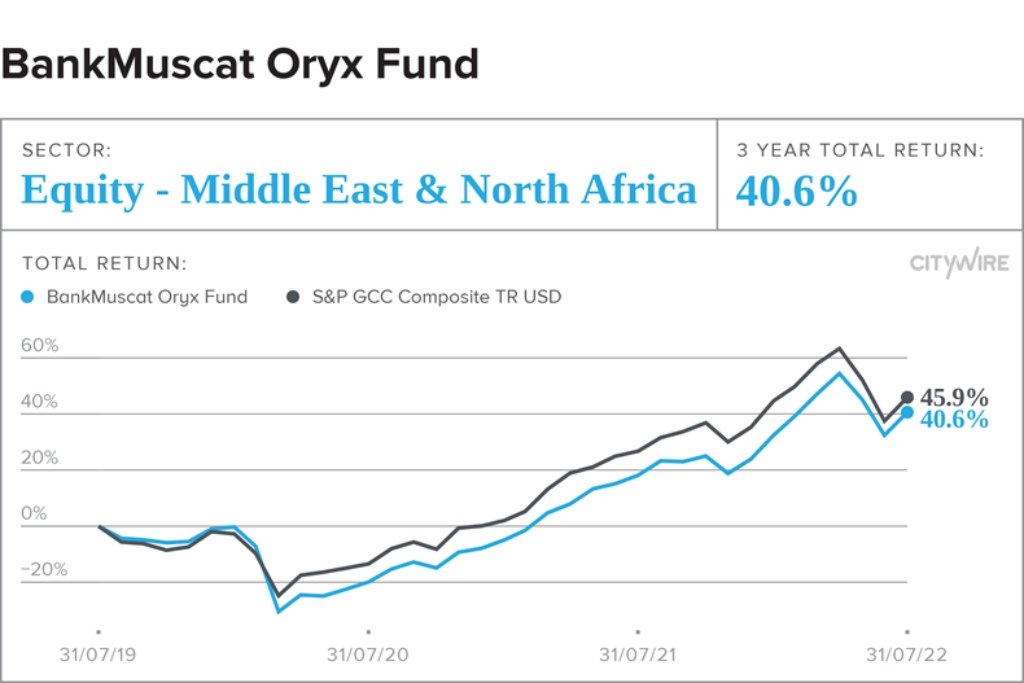

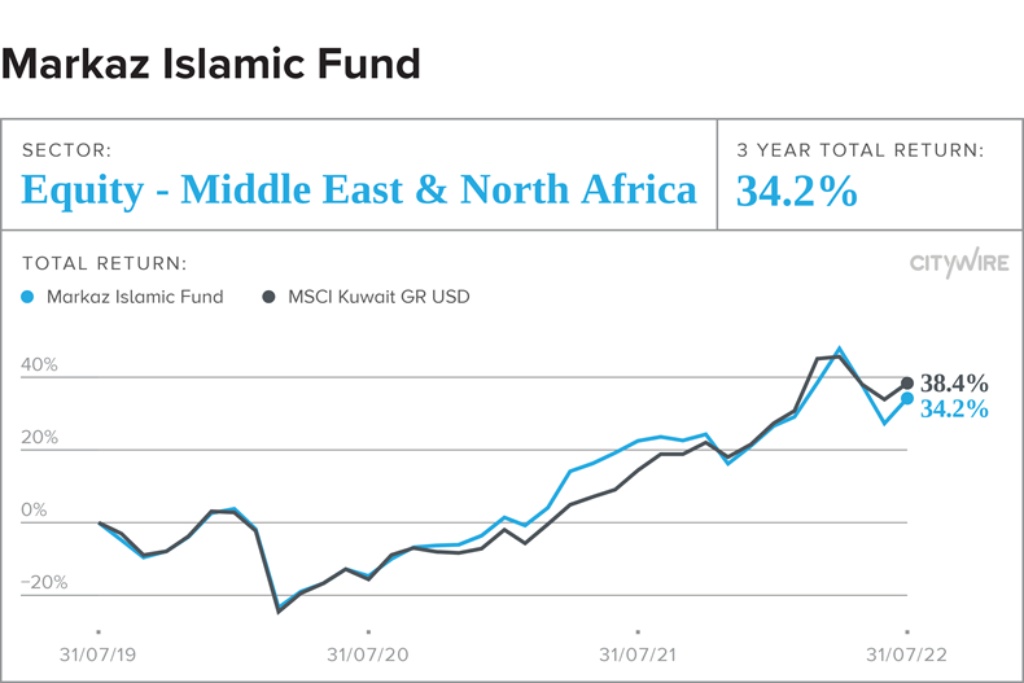

Performance as % Total Return in USD. Total returns calculated gross of tax, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Source: Morningstar / Time period: 3 years (31/07/2019 to 31/07/2022)

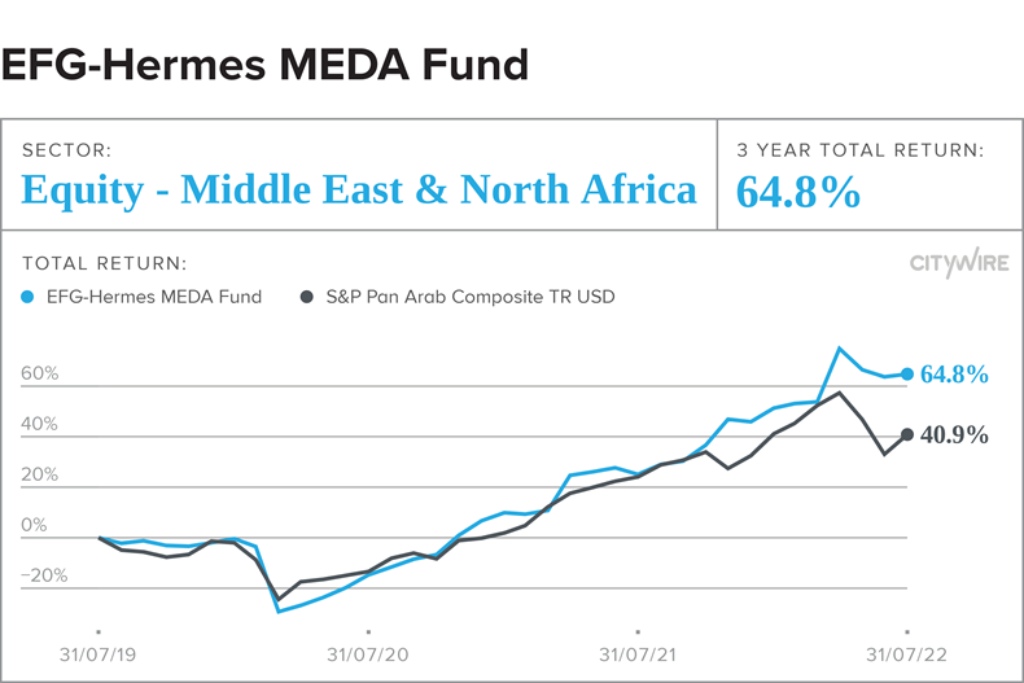

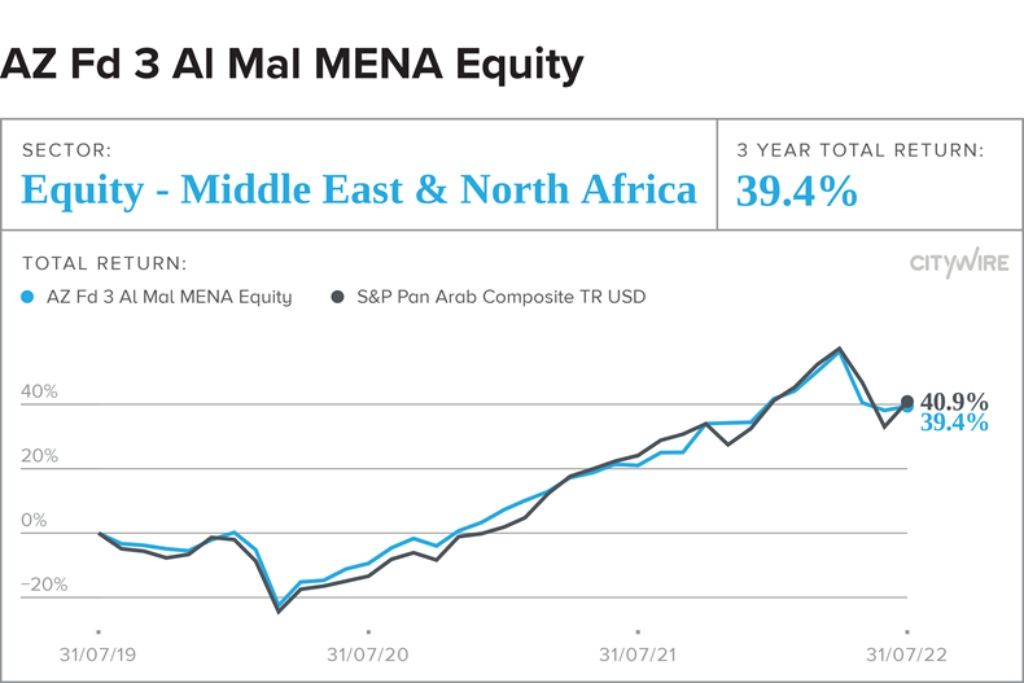

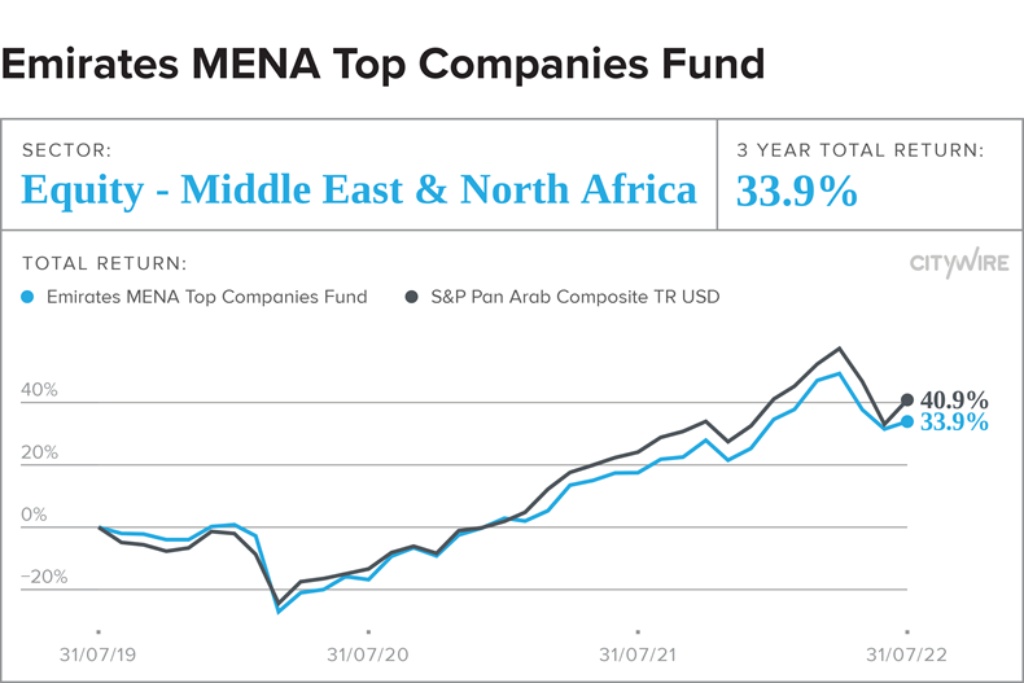

Performance as % Total Return in USD. Total returns calculated gross of tax, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Source: Morningstar / Time period: 3 years (31/07/2019 to 31/07/2022)

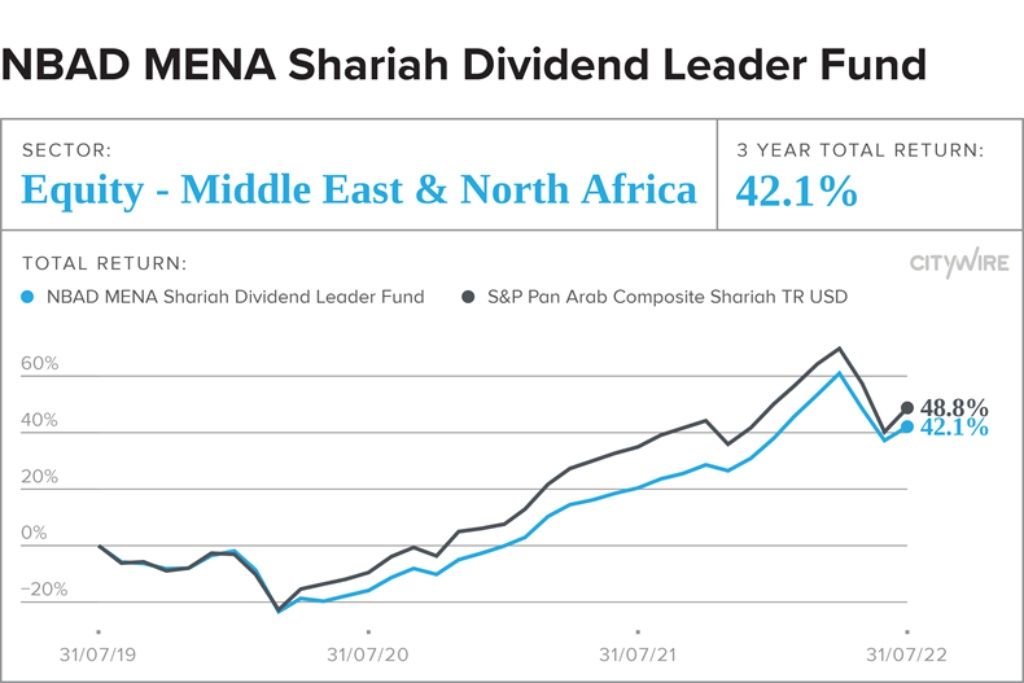

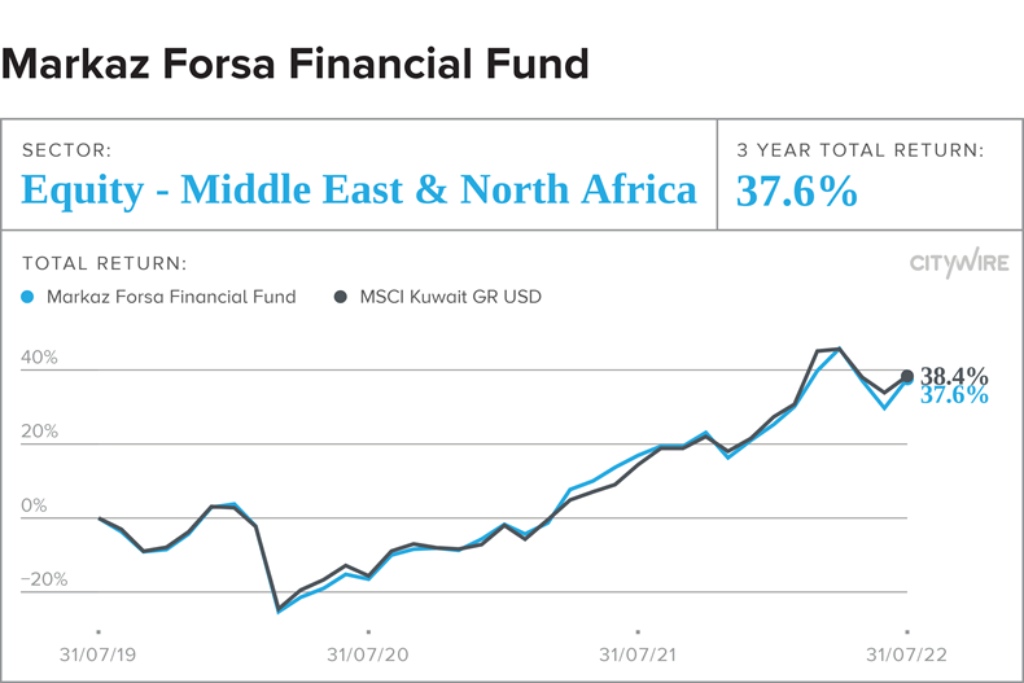

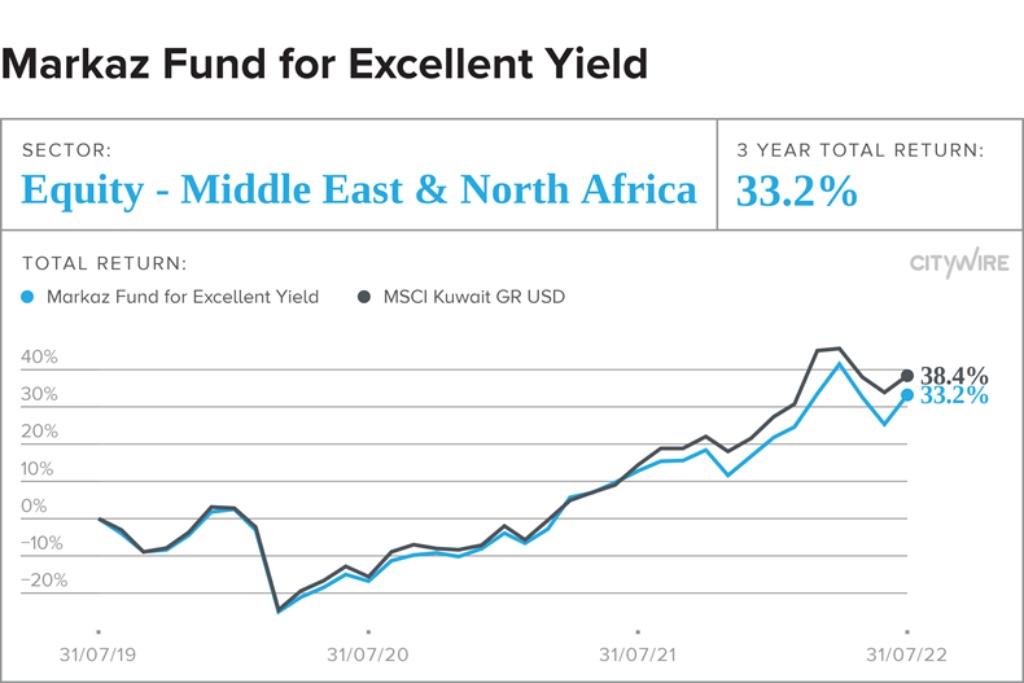

Performance as % Total Return in USD. Total returns calculated gross of tax, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Source: Morningstar / Time period: 3 years (31/07/2019 to 31/07/2022)

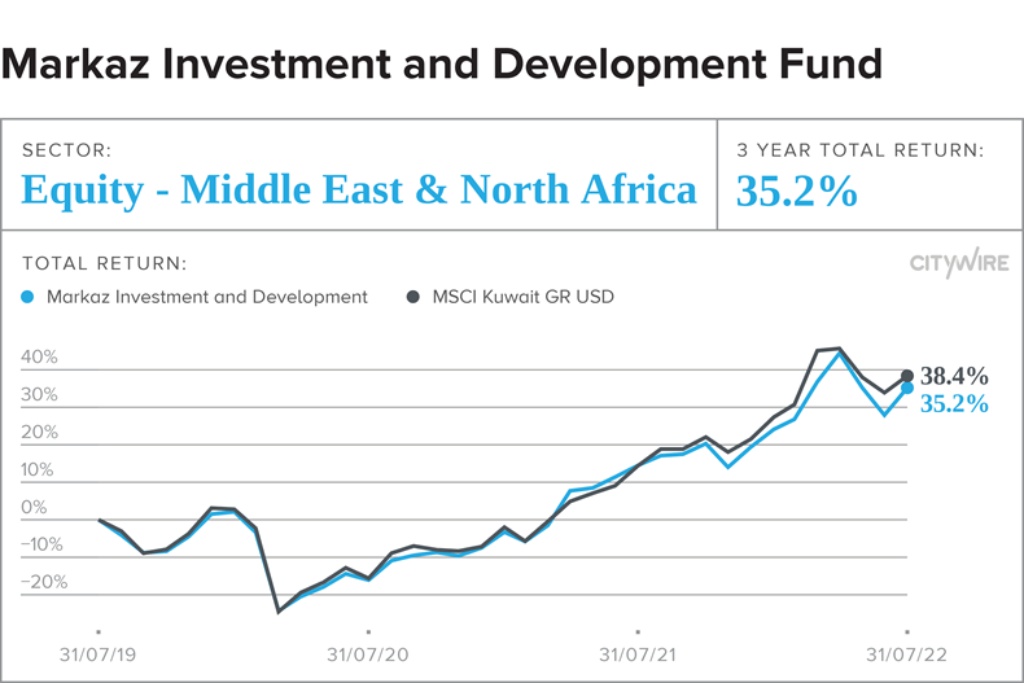

Performance as % Total Return in USD. Total returns calculated gross of tax, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Source: Morningstar / Time period: 3 years (31/07/2019 to 31/07/2022)

Performance as % Total Return in USD. Total returns calculated gross of tax, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Source: Morningstar / Time period: 3 years (31/07/2019 to 31/07/2022)

Performance as % Total Return in USD. Total returns calculated gross of tax, ignoring the effect of initial charges and with income reinvested at the ex-dividend date. Source: Morningstar / Time period: 3 years (31/07/2019 to 31/07/2022)